Traditional vs Roth IRA Calculator

If you are considering contributing to a Traditional or Roth IRA (or 401k), you may have already heard that the main difference is whether the contributions are made pre-tax or after tax. Also, you should have been told that one of the main considerations is whether you think your income tax bracket during retirement will be higher or lower than your current tax bracket. Your next question might be "How much difference will it make?" That is this question this calculator was designed to answer.

Another important difference between a Traditional and Roth IRA is that if you need access to your money, it is easier to pull some money out of a Roth because you are not penalized when you withdraw your principal (contribution amount) from your Roth IRA. But, that is not what this calculator is for. This page doesn't talk about everything you might want to know when deciding between a Traditional or Roth IRA. See the references at the bottom of this page for more information (especially the article on nerdwallet.com).

Traditional vs. Roth IRA Calculator

for Excel

Description

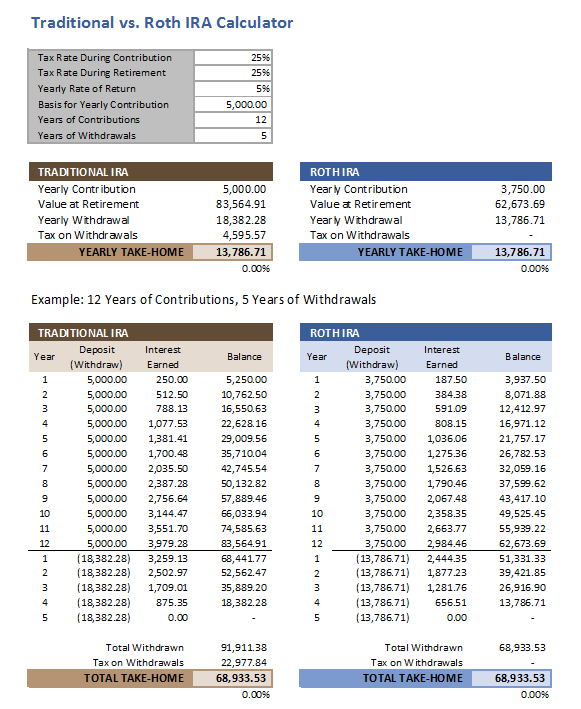

This calculator is meant to compare the difference between investing in Traditional and Roth IRA accounts based on your tax rates during the contribution phase and during retirement. The screenshot above shows the results for when the tax rates are not different (notice that the take-home amounts are the same).

The PERCENT DIFFERENCE between the Yearly Take-Home (or Total Take-Home) depends only on the difference in the income tax rates before and after retirement. It's one thing to say that, but you can download this spreadsheet and analyze the formulas for yourself to see how it works. The spreadsheet also includes a couple comparison charts that are explained below.

How Does The Calculator Work?

Pre-Tax (Traditional) vs. After-Tax (Roth) Contributions

The Basis for Yearly Contribution amount represents your pre-tax income that you plan to contribute.

If your basis is $5000, then the entire $5000 is contributed pre-tax into the Traditional IRA. With the Roth, you first have to pay tax on it. If we assume a tax rate of 25%, that means you will contribute $5000 * (1-25%) = $3750.

To keep things simple, in this calculator we assume that the contribution is made in one lump sum at the beginning of the year. You might be making monthly automated payments to your retirement plan via deductions from your paycheck, but for the purpose of comparing Traditional vs. Roth, that doesn't matter.

Investments Grow Tax-Free Within Each Type of Account

One of the main advantages of BOTH account types is that while the money is sitting in your account, you do NOT pay tax on dividends or capital gains or interest earned. This is usually seen as an advantage, but it also means that if there is a market crash, there is no tax advantage to selling stocks in your accounts at a loss.

In the calculator, we make a simple assumption about the yearly rate of return so you don't have to worry about how tax rates might affect the growth.

We use the simple future value FV() function to estimate the Value at Retirement, but if you are curious about how the balance changes, you can look at the example that shows 12 years of contributions.

If you are interested in a more detailed calculator for estimating your retirement savings, check out the Retirement Calculator

Yearly Withdrawal During Retirement

For the retirement phase, we've made the assumption that the full amount for the year is withdrawn at the beginning of the year. Although this affects the amount of interest earned (compared to making monthly withdrawals), the purpose of this calculator is to simplify the process of comparing the difference between the Traditional vs. Roth.

See the annuity calculator, retirement withdrawal calculator, or retirement calculator if you want a more detailed analysis.

Tax on Withdrawals

Traditional IRA: You pay income tax on the FULL amount of the withdrawals during retirement. That is why the general rule of thumb is to use a Traditional IRA if you think you will be in a lower tax rate during retirement.

Roth IRA: You pay NO tax on withdrawals during retirement, not even on the capital gains or interest earned.

It Boils Down To ...

I personally think that the ability to withdraw needed principal from the Roth for an emergency (penalty free) is a big advantage to the Roth. However, if we ignore these types of issues and look only at the basic math, the difference between the Traditional and Roth IRA boils down to just the difference in tax rates before and after retirement.

The amount of the contribution, the rate of return, and the years before retirement, and the years of withdrawals all affect the amount you can withdraw during retirement. However, the PERCENT DIFFERENCE between the Traditional and Roth IRA (based on the simplifying assumptions I've explained above) depends only on the tax rates. You can verify that for yourself by downloading the calculator.

We created two charts for comparing the % difference between the Take-Home amount for the Traditional vs. Roth IRA based only on the tax rates during the contribution phase and during the retirement phase. Note: these are not federal tax "brackets" because income tax includes both federal and state taxes.

Is a Traditional IRA Better? The chart below shows that a 35% tax rate during contribution vs. 15% tax rate during retirement means that the take-home amount (after tax) in retirement is 30.8% higher if you contributed to a Traditional IRA.

Is a Roth IRA Better? The chart below shows that if your tax rate is 15% during contribution and 25% in retirement, the take home amount with the Roth IRA is 13.3% higher.

Will My Tax Bracket Be Higher or Lower in Retirement? That's the question, isn't it. We can't predict the future. Your CPA can probably do an analysis for you to guess at the answer to this, but even your CPA can't predict the future.

Do you have a great job now but expect your retirement income to be less? Will a debt crisis and failure of social security in our country require that tax rates be higher for everybody after a couple decades? How often do we see tax rates decrease? Does it really matter and will you even care? If your tax rate doesn't change much, should you have considered the other pros and cons of the different accounts?

You may have more questions now than you did before, but we hope you've also learned more through using this calculator.