Retirement Withdrawal Calculator

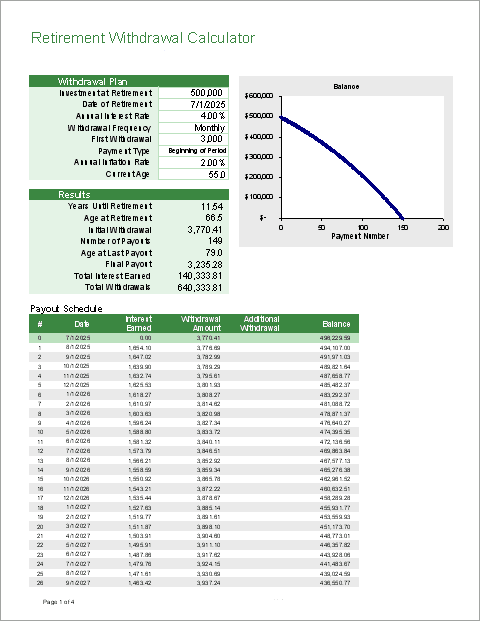

How long will your retirement nest egg last? That is what this new spreadsheet-based calculator can help you figure out. It simulates the case where a person makes regular withdrawals from an account that is also earning interest. The spreadsheet gives you much more control over your savings withdrawal plan than most online calculators. For example, in the payout schedule, you can enter additional withdrawal amounts to either add to or reduce the amount of a withdrawal for a specific period. And of course, because it is a spreadsheet, you can delve deep to figure out exactly how the formulas work.

Retirement Withdrawal Calculator

for Excel

Description

- Enter the amount you expect to withdraw in today's dollars. The initial withdrawal will be adjusted for inflation based on the number of years until your retirement.

- Enter an annual inflation rate to automatically increase the amount withdrawn each period. This is an important part of any retirement planning calculation.

- Create a monthly or annual payout schedule. You are more likely to make monthly withdrawals, but for a quick analysis and a more concise payout schedule, the annual option is handy.

- Make adjustments to the normal scheduled withdrawal by entering an Additional Withdrawal amount within the Payout Schedule, either positive or negative. For example, you could use this feature to see what a huge one-time medical bill might do to the plan.

- Choose whether the withdrawal is made at the beginning or end of a month or year. Choosing "beginning" means the first withdrawal is made before any interest is earned.

- View a graph of the balance over time.

- The table includes an Age column and the graph uses Age as the horizontal axis.

Update 1/9/2020 - The error in the Total Withdrawals field was fixed (error introduced accidentally during 7/10/2019 update). It should be adding the Withdrawal Amount column and the Additional Withdrawal column (not the Interest Earned column).

Update 12/9/2020 - The Age column in the table was fixed for the choice of an Annual withdrawal frequency. The Age column was added to the Google Sheets version, also.

Taxes: This spreadsheet doesn't include any tax calculations. The main assumption with regard to taxes is that the interest is earned tax free within the retirement account. That is usually a pretty good assumption, but if you want to take taxes into account, you can use a tax-adjusted interest rate. For example, if interest is taxed at the rate of 15%, you can calculate a tax-adjusted interest rate as =(1-rate)*15%

Early Withdrawal Fees: This is another thing that the spreadsheet does not take into account. However, because you can add Additional Withdrawal amounts, you could make adjustments to the first few payouts if you needed to withdraw more to cover these types of fees.

FAQ

How much should I save for retirement?

To answer that, you'll need to figure out (1) How many years you want the nest egg to last, (2) How much you need to withdraw each period, and (3) How much you are willing to work and save to reach that goal. You can use this calculator to help with (1) and (2): Just change the Investment at Retirement value until the Age at Last Payout is what you want it to be. You can use one of our other savings calculators to help with (3).

How much should I withdraw each month?

The amount you plan to withdraw is entered in today's dollars, so it should be based on what you think you will need when you start retirement.

To help answer this question, you'll need to create a budget. We have many free budget spreadsheets you can use.

How do I reduce or change the withdrawal in later years?

The spreadsheet increases the withdrawal amount based on inflation, but you can use the Additional Withdrawal column to enter positive or negative values to adjust the withdrawal amount.

I've updated the XLSX version of the spreadsheet to include an Age column in the Payout Schedule to help make it easier to plan your withdrawals. Changes in your planned withdrawals will typically be based on your age.

This question resulted from somebody wanting to implement an annual decrease in spending at certain ages, somewhat like the online calculator at TheCalculatorSite.com.