Debt Snowball Calculator

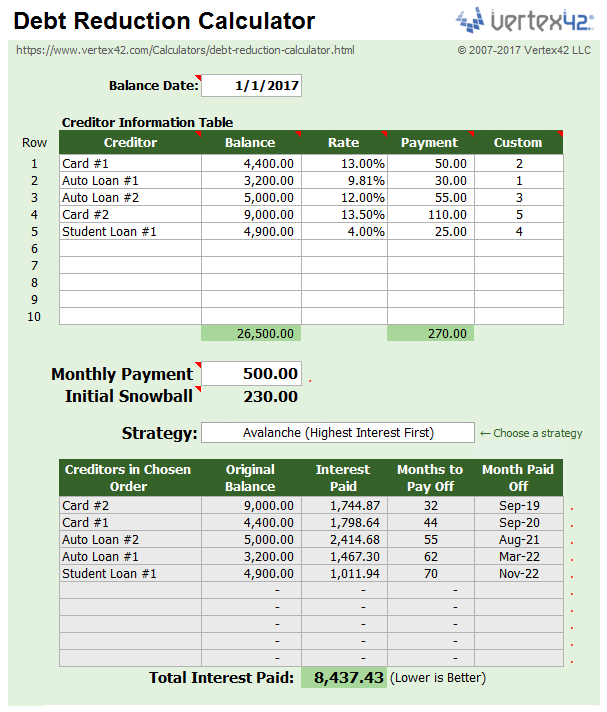

How fast can I get out of debt? How much can I save in interest payments? Use our Debt Reduction Calculator to help answer those questions. Getting out of debt is not easy, but with a good plan and firm determination, it is entirely possible. The debt snowball calculator is a simple spreadsheet available for Microsoft Excel® and Google Sheets that helps you come up with a plan. It uses the debt roll-up approach, also known as the debt snowball, to create a payment schedule that shows how you can most effectively pay off your debts.

One of the most powerful things about this spreadsheet is the ability to choose or create different debt reduction strategies, including the popular debt snowball (paying the lowest balance first) or the debt avalanche (paying the highest-interest first). Just choose the strategy from a dropdown box after you enter your creditor information into the worksheet. These snowball strategies could possibly save you $100's or even $1,000's of dollars.

Regardless of the strategy you choose, the first step in a debt snowball plan is to make a budget, then stick to it. The more you can squeeze out of your budget to increase your debt snowball, the faster you'll reach your goals.

You should consider other financial goals and risk factors besides just paying off debt as fast as possible. But, after you've decided what you can contribute to debt payoff each month, enter that amount into the calculator as your total Monthly Payment. This total monthly payment remains the same each month. The thing that changes is the portion of that payment (i.e. the snowball) that is thrown at your current debt target. Continue reading below for more information about the various debt reduction strategies.

Debt Reduction Calculator

for Excel and Google SheetsDownload

Over 1.4 million downloads!

⤓ Excel (.xlsx)Include up to 10 creditors. Purchase the extended or pro version to list up to 20 or 40!

Other Versions

Update 2/17/2020 - Fixed the formula in the Google Sheets versions where the "Months to Pay Off" didn't work when the minimum payment is zero.

Description

"Just wanted to thank you for the debt reduction calculator spreadsheet. It has helped me to get my debt under control and I will be debt free with the exception of my mortgage in a couple months. I started with about $42k of debt and will have paid it off in a little over 2 years with the help of the spreadsheet and insane budgeting."- Lisa

Use our debt snowball calculator to help you eliminate your credit card, auto, student loan, and other debts. Easily create a debt reduction schedule based on the popular debt snowball strategy, or experiment with your own custom strategy.

In the first worksheet, you enter your creditor information and your total monthly payment. You'll then see a summary of when each of the debts will be paid off based on the strategy you choose.

The second worksheet is a payment schedule for you to print to keep track of your progress. You can also see how the snowball increases as you pay off your debts.

A Snowball Growth Chart lets you see how the snowball increases and your interest due decreases over time (only in the Excel versions).

You may also want to check out the Credit Repair edition of this calculator, which is designed to help improve FICO scores by lowering the balance-to-credit-limit ratio of individual debts.

Update 2/17/2020 - Fixed the formula in the Google Sheets versions where the "Months to Pay Off" didn't work when the minimum payment is zero.

Description

"We have multiple rentals, and so mortgage loans. We were paying down each loan, distributing our liquid cash among all the loans evenly. When we found the debt reduction calculator we ran multiple preprogramed scenarios, and a couple of our own and discovered the optimum method for us. The Debt Reduction Calculator saved us hours of time, a quarter of a million dollars and will result in our paying off all loans in 1/2 the time. Thanks for sharing a great way to evaluate and strategize debt reduction."- Morgen Kimbrell & David Hayhurst

The Pro version of the calculator serves two main purposes:

1. You can list more than 10 creditors

One of the included files lets you list up to 20 creditors, and if that isn't enough, there is also a version that lets you list up to 40.

2. The Commercial Use License allows you to use the spreadsheet in your business.

- Unlike the free version, which is allowed only for personal use, you can use the pro version to help clients that you are advising.

- The templates includes a section at the top to list your client's name and the preparer's name and address (see the screenshot).

- You can use it to print reports or create PDF reports, but the commercial license doesn't permit sharing the actual spreadsheet file.

- Bonus Spreadsheet: The pro version includes a commercial license of the Credit Repair edition.

Using the Debt Snowball Calculator

Follow these simple steps to use the debt snowball worksheet:

- Enter abbreviated names for your credit card or lending institution, the current balances, and the interest rate information for all of your current debts (including home equity lines of credit or second mortgages).

- Enter the minimum payment you will make each month for each debt. You may need to verify your minimum payment with your lending institution. For some debts, like credit cards, the minimum payment may change over time. This spreadsheet assumes a fixed minimum payment for each debt, so you may want to update the calculator every few months.

- Enter the total monthly payment that you can pay each month towards your debts, based on your home budget. The difference between the total minimum payments and your total monthly payment is your initial snowball. This initial snowball, or "extra payment," is applied to one debt target at a time, depending on the order defined by your chosen strategy.

- Look at the results table to see the debts in your chosen order along with the total interest paid and the months to pay off each debt. Experiment with choosing different payoff strategies or use the Custom column to choose the order to target your debts.

How Does the Snowball Effect Work?

The snowball effect is the idea that a snowball grows as it rolls down a hill. When applied to debt reduction, the snowball effect refers to how your extra payment grows as you pay off each debt.

As defined above, the snowball is the difference between your total minimum payments and your total monthly debt payment. The total monthly debt payment remains the same from month to month. The snowball is the extra payment that you will make on your current debt target.

After you pay off your first debt, you no longer need to make the minimum payment on that debt. So, that payment amount gets rolled into your snowball. Your new larger snowball becomes the extra payment that you apply to the next debt in the sequence.

There are times when your snowball is larger than the remaining balance on your current debt target. In that case, the spreadsheet automatically divides your snowball between the current and next target.

Debt Reduction Strategies

This section describes the different strategies that you can choose within the debt snowball spreadsheet. Each of these strategies has to do with the order that you target your debts with your snowball.

Unless you choose the "No Snowball" option, ALL of these strategies make use of the snowball effect described above. For more information, see Dave Ramsey's article on the debt snowball effect, or read his book, "The Total Money Makeover".

- Debt Snowball (Lowest Balance First): Even though the snowball effect applies to all of these strategies, the debt snowball strategy usually refers to the method of paying the lowest balance first. The benefit of this method is the psychological effect of seeing the number of debts disappear quickly. According to Dave Ramsey, it is important to build momentum and see success early on. After all, if it was easy to pay off debt, you probably wouldn't need this calculator.

- Debt Avalanche (Highest Interest First): This strategy results in the lowest total interest, but depending on the balance of your higher interest loans, it may take you longer to see your first loan/debt completely paid off. If the difference in the total interest is not significant, than you may get more satisfaction and success from the Lowest Balance First method.

- No Snowball: Select this option if you want to see how long it will take to pay

off the debts based solely on the individual minimum payments you specify (i.e. no snowball effect). In some cases, you may find it will take more than 30 years to pay off some debts. This is more of an anti-strategy, but it can be interesting.

- User-Specified Order: There are three options for choosing the order that you want to pay your debts. You can choose "Order Entered in Table", which is self-explanatory. You can also use the Custom column to enter your own formulas or your own ranking and choose "Custom-Highest First" or "Custom-Lowest First". I'd suggest ranking each row using values "10, 20, 30, 40, etc." . The reason to enter the order by 10's or 100's is so that you can easily switch the order. For example, you can move the one marked "30" ahead of "20" by changing the 30 to 19. You can also use the built-in SORT command via the Data menu.

- Debt Snowflaking: This is a term for making extra debt payments above the normal monthly payment (above and beyond the normal snowball). You can add "snowflakes" for any given month, using the "Additional" column in the PaymentSchedule worksheet. See the article to see how to add snowflakes to the debt snowball calculator.

Variation on the Debt Snowball Strategy

If you choose the "Lowest Balance First" method, and two of your balances are roughly the same amount, but have very different interest rates, you might want to switch the order that you pay them off so that you pay the higher rate first. It might not make much difference in how long it takes to pay them off, but it could make a difference in how much interest you end up paying.

To use this approach in the worksheet, you'll need to choose the "User-Specified Order" methods described above.

Stair-Stepper Strategy

The stair-stepper strategy, integrated into the Google Sheets versions of the debt reduction calculator, was devised by Carlotta Thompson (carlottathompson.com). It is a clever compromise between the Lowest Balance First and Highest Interest First strategies.

In this approach, the debts are grouped into categories based on the balance ($0-$2500, $2501-$5000, etc.). Beginning with the lowest balance category, you pay off the debts from highest to lowest interest rate, then move on to the next higher balance category.

Cash Flow and Liquidity Considerations

As you pay off debts, your net cash flow increases, and that extra cash is what causes your debt snowball to increase. Credit cards are typically the first debts to pay off because of their high interest rates, but cash flow is another reason to target the credit cards first.

A credit card payment is usually calculated as a percentage of your balance. That means that as you pay off your credit card balance, your minimum payment decreases. To see how that works, download the credit card minimum payment calculator.

Unfortunately, the debt reduction calculator only assumes a fixed minimum payment, so you don't see the debt snowball gradually increasing as you pay off credit cards. But, if you are concerned about cash flow, remember that paying off credit cards (or other debts with a decreasing minimum payment) gives you an immediate increase in net cash flow.

On the other hand, most auto and home loans have fixed payments. So, you don't see the increase in cash flow until the entire debt is paid off (or if you refactor the loan to lower the minimum payment).

This brings up the concept of Liquidity Risk, as explained in my article "" Paying off debt decreases your liquidity (the availability of cash or liquid assets). A decrease in liquidity is a risk because it reduces your ability to pay unexpected expenses or to make a timely investment.

As you make payments on your credit card or other lines of credit, the liquidity risk is lower because you can quickly withdraw the money again if necessary (assuming your credit isn't frozen). That would increase your debt, of course, but it lowers the risk of being unable to keep the electricity running. On the other hand, if your extra cash is used to pay off an auto loan, you can't just get another loan in a couple of hours.

What does this have to do with your debt snowball strategy? It is just another reason why you may want to customize the order that you pay off your debts.

Warning: It may be tempting to put your full financial strength into paying off your debts. Be careful about doing that. You need to balance your debt reduction goals with the need for an emergency fund and other important financial goals. In these cases, it can be useful to seek the advice of a qualified professional.

Debt Reduction Resources

- How to Get Out of Debt with the Debt Snowball Plan at daveramsey.com

- Choosing and Using Credit Cards at www.ftc.gov.

- Credit, Debit, and Charge Cards at www.ftc.gov

- Online Debt Reduction Calculator at extension.usu.edu (used to be www.PowerPay.org) - I used this to compare with the spreadsheet. It allows a few more options for minimum payments.

- Use the Snowball Calculator to Pay Off Debts - at LifeHacker.com - Many comments from people who have used the technique.

- Sample Letter to Student Loan Servicer - at consumerfinance.gov, Oct 16, 2013 - This article includes a sample letter for explaining to your loan servicer how you want your extra payments to be applied.