Small Business Start Up Costs

No matter what kind of business you intend on owning, it is a good idea to estimate your business startup expenses prior to jumping in. Whether you plan on starting a small business or a larger franchise, you may be surprised at the total start up cost. Nearly all new business owners underestimate the cost of starting their business, leaving it exposed to the risks of being underfunded. To help you avoid this common mistake, use our Free Business Start Up Costs Template to help you determine how much money you need to get your start up business up and running safely. See below for additional information, tips and resources.

Calculating business start up costs should be a part of starting any business. An entrepreneur is usually required to put these costs together as part of a business plan, loan or grant application. They are also helpful when putting together proforma financial statements.

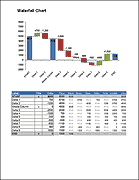

Business Start Up Costs Template

for Excel, OpenOffice

Description

This Excel workbook will help you put together an estimate of costs and funding required to start your business. It is pre-populated with expense categories common to many small businesses and home-based businesses, so it can be very useful in helping you identify all of your start up costs, including many you may not have considered.

As you add your own costs or expense categories, the template will help you understand whether you have adequate funding. Once you have your funding secured and you pull the trigger, use the worksheet to track your actual expenditures to help you keep your costs under control.

As you get your business going, you may want to consider using a more detailed business budget and other financial statements.

Starting a restaurant? This free template also includes a customized start up cost sheet with many cost categories specific to owning and operating a restaurant. Perfect for helping you capture all of those Restaurant Start up Costs.

Starting a franchise, web business or home business? Continue reading below for some help with costs specific to these types of businesses as well as links to other helpful resources.

Start Up Costs for Different Businesses

Restaurant Business Start Up Costs

Starting a restaurant can be expensive because of the specialized equipment and facilities that are required. Luckily, there are usually leasing options available for the expensive items and many landlords will work with you on leasehold improvements. Use the Restaurant specific worksheet in the Business Start up Cost Template to help you consider other expenses such as cleaning costs, uniforms, menu development and supplier sourcing costs.

Home Business Startup Costs

The nice thing about a home based business is that you can forgo many of the typical expenses of a startup. Things like internet, office space, furniture and utilities are already taken care of. Better yet, if you qualify for the home office deduction, now you can write some of these items off as business expenses. Simply put $0 in the template or delete the rows for those expenses already covered. If you are starting a home-based internet business, continue on to the next section.

Internet Business Startup Costs

A web based business may be one of the least expensive businesses to start, especially if you can do the web development work yourself. Use the basic template and decide which expenses apply to you – simply delete the rest. You may also want to consider some items not listed, such as custom web page design and development work, custom database development and scripting, search engine optimization (SEO) and advanced hosting services to name a few. Also, if your business is retail, don't forget to include all of the referral and usage fees for selling through storefronts like Amazon and Ebay.

Franchise Business Start Up Costs

Our Business Start up Cost Template will also help you if you are looking for a start up franchise opportunity or looking for franchises for sale. Along with all of the regular costs of starting a business, the template also includes categories for fixed franchise fees as well as monthly franchise dues and marketing co-op fees. You may also want to check with the franchise corporate offices. Many of them provide tools to help you estimate your start up and operating costs.

How to Use the Business Startup Cost Template

The key to putting together accurate numbers is to get into the details. This requires doing detailed research by calling suppliers and providers, searching the internet and listing any and all costs that may be applicable. To help you, the business cost template comes pre-populated with many of the most common expense categories. It also contains additional suggestions and tips for each category to help you make sure you considered everything. Feel free to add additional line items that are unique to your business.

Funding Sources

Start by listing the sources of funding that you believe will be available to you in the Estimated column. This would include money supplied by owners and investors, funds available from bank loans or other lines of credit. In some cases you may be pursuing other sources of funds such as grants, endowments or sale of assets.

Fixed Costs

After all your funding sources have been outlined, start putting in the estimated fixed costs. These costs are one-time costs associated with getting your business up and running. This includes things like leasing space, purchasing assets, stocking up on inventory and getting your legal and marketing issues in order.

Two key parts to the fixed costs are the Working Capital and a Reserve for Contingencies – these can be significant. Any startup is advised to have a Contingency Fund as there are always last minute surprise costs and fees. Consider the risks of your business and set aside sufficient funds accordingly.

Be sure to include enough Working Capital to fund your normal business operations as you grow. Remember that there can be a significant amount of time between when a sale is made and when you actually receive payment. Sufficient working capital is needed to allow you to continue to purchase inventory and pay bills while waiting for payment. More than one growing business has failed because it lacked sufficient working capital.

Monthly Costs - Until Profitable

Many entrepreneurs fail to understand that businesses are seldom profitable the first day. In order to have a clear picture of actual cash required, it is important to estimate your monthly operating costs as well as how many months it will take you to move from the red to the black. The template is setup to assist you in determining these important costs. Simply identify how many months you believe it will take to get up and running and fill in the estimated monthly costs.

Ready, Set, Go

As a time window is provided and all the sources and costs are identified, the spreadsheet will calculate whether you have a surplus or deficit in funding. If you have a deficit, then you will need to figure out if there are ways to scale back your costs or look for additional funding. If you have surplus and are confident in your numbers, you may be good to go.

Keeping Things in Check

The excitement of starting the business can cause entrepreneurs to spend more than they planned. Use the template to keep you grounded. As you collect funds and begin to spend money, record the Actual amounts next to the Estimated numbers. The spreadsheet will calculate whether you are running over or under you estimated numbers so you can make adjustments as you go.