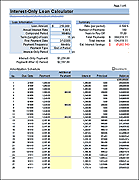

Interest-Only Loan Calculator

The TotalSheets™ Interest-Only Loan Calculator is a very powerful spreadsheet based on our popular Loan Amortization Schedule. It helps you calculate your interest only loan payment for a fixed-rate loan or mortgage and lets you specify the length of the interest-only (IO) period. You can also calculate the effect of including extra payments before and after the IO period.

What is an Interest-Only Mortgage Loan?

Both fixed-rate and variable-rate loans and mortgages often give you an interest-only payment option. This option allows you to make payments, for a certain number of years, that include interest only (no principal). The result is a lower payment during the first few years (or months) of the loan.

During the interest-only period, you are usually allowed to make extra payments on the principal if you want to, without paying any penalty fees.

At the end of the IO period, the new monthly payment is calculated based on the number of years you have remaining on your loan and your current balance.

Luckily, you don't need to do these calculations yourself. Let the spreadsheet do it for you.

Interest Only Loan Calculator

for Excel

Description

This spreadsheet creates an amortization schedule for a fixed-rate loan, with optional extra payments and an optional interest-only period. It will work for an interest-only loan or interest-only mortgage.

Update 8/17/2018: The main XLSX version for Excel 2007+ has been updated to allow duplicating the loan worksheet (for comparing different loans within the same workbook). We've also made a few cosmetic changes and updated comments and help info.

A commercial use version of this Interest-Only Loan calculator is included as a bonus spreadsheet when you purchase the Loan Amortization Schedule.

How to use the Interest-Only Calculator

Our spreadsheet should be pretty intuitive to use. Simply enter your loan information in the cells with the white background and everything else is calculated automatically. If you want to include extra payments, you enter them in the amortization table.

Be sure to read the comments within the file (marked with a little red triangle on some of the cells) if you have questions.

Is an Interest-Only Loan Good for Me?

I can't answer that for you, but I would strongly recommend reading through the material listed in the references below. A fixed-rate loan with an interest-only option is fairly simple to understand and predict, but interest-only mortgages with adjustable rates seem much more risky.