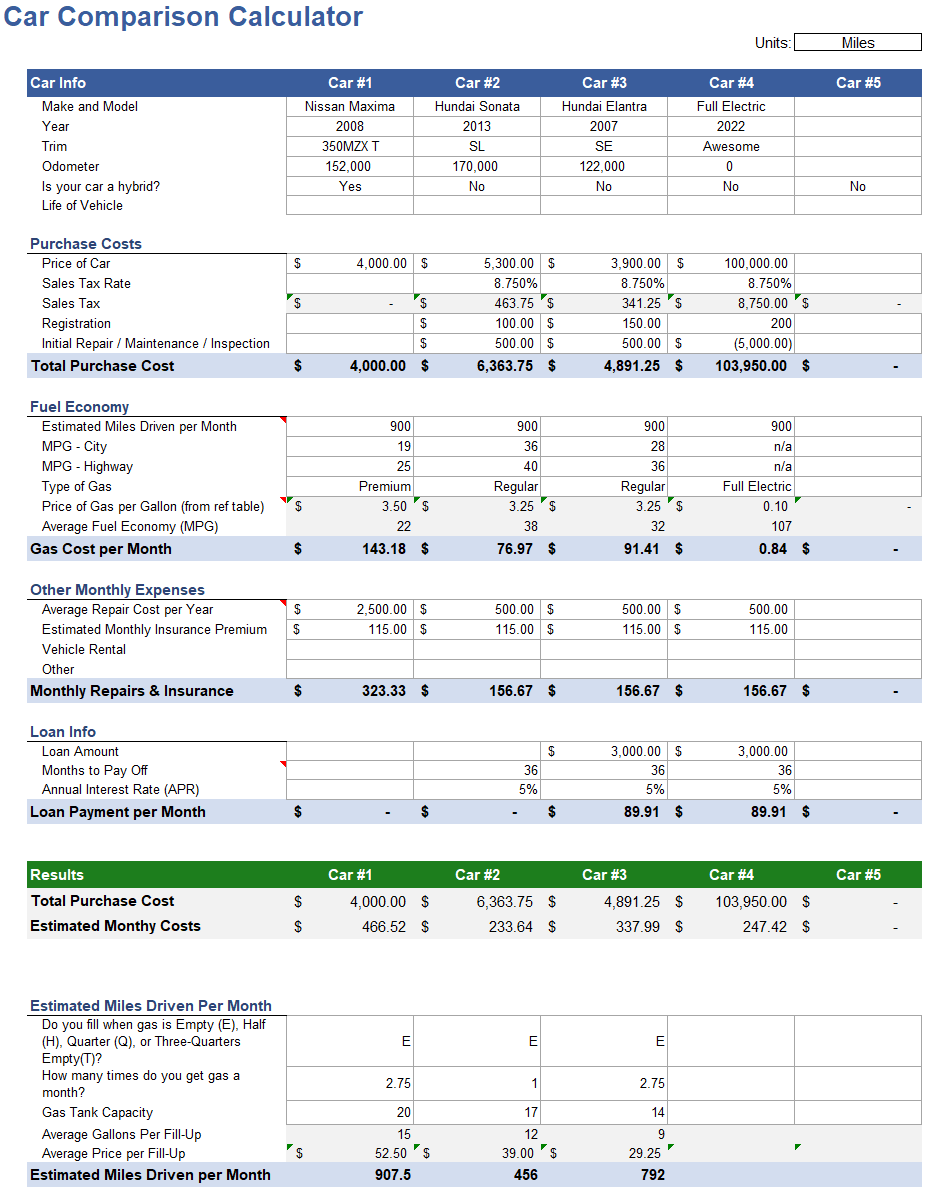

Car Comparison Calculator: Compare Cars Side-by-Side

Are you looking for a car finance calculator, or to compare cars side-by-side? This car comparison calculator in Excel helps you visualize how much you are paying for your current car, and what a future car’s finances may look like. You could also use this car comparison tool to decide if you should lease or buy a car. Plug in your auto loan payments to calculate your monthly car finances.

Car Comparison Calculator

for Excel

Description

Buying a new or used car always comes with a lot of questions. Is buying a different car worth it? Is a used car or a new car a better deal financially? How do I know if I can afford a different car?

This car calculator spreadsheet helps answer these questions so you can have more confidence in your decision to purchase, or not purchase, a car. This spreadsheet lets you compare multiple vehicles. Enter the price, mileage, loan info and repair costs to estimate the overall cost and monthly upkeep.

How to Use the Car Comparison Calculator

Customize the template with the cars that you would like to compare. You can compare with your current car and/or many different cars.

Some of the important details you will need to input about the cars you are comparing include:

- gas mileage

- gas tank capacity

- what type of gas the car takes

- loan information (amount, months to pay off, APR)

- local gas prices (enter into a separate table below the main calculator)

To get the most out of this spreadsheet, try and input your data as accurately as possible. If you are unsure of the answer, many of the specs can be found on Google by simply looking up the car’s make, model, and year. For other fields that you cannot find an exact answer, you may need to estimate. Try different values to see how the input affects the result.

Estimated Miles Driven Per Month

If you don't know how many miles/kilometers you drive a month, you can use the "Estimated Miles/Kilometers Driven Per Month" calculator in this template underneath the "Results" section. Input your distance driven estimate into the correct cell in the Fuel Economy section of the spreadsheet. This section of the worksheet is optional and designed to help you estimate a value for the corresponding cell. This sub-calculator includes inputs such as your habitual fill up amount (half full, on empty, etc) as well as the car’s tank capacity. If you are interested in keeping track of your gas mileage long term, check out our Gas Mileage Log.

Compare Multiple Cars

This spreadsheet was designed to make it easy to do side-by-side comparisons between multiple cars, including your current one, with the main decision factor being the estimated monthly cost of ownership. Some of the questions to consider are:

Should I buy a car or just keep my current one?

Some of the main factors affecting this type of decision (besides just wanting a new look) may include gas mileage, maintenance costs, and the cost of financing. Another more subjective consideration has to do with reliability, or how long you expect the car to last. You may feel forced to get a new car to fit your growing family, but comparing the cost of your current vehicle may still be important because you tend to know a lot more about the expenses of your current vehicle, which may help you have a benchmark for comparison. If you want to calculate the specifics of the auto loan that would come with the purchase of a car, check out our Auto Loan Calculator.

Should I buy or lease a car?

Although leasing a car is typically more expensive than buying used and sometimes more expensive than buying new, comparing the cost of leasing a car can provide a useful benchmark. Leasing a car is typically a short term solution, and may have other drawbacks such as mileage restrictions, hidden fees, or contract length (penalties for terminating the contract early for example).

Should I buy a new or used car?

If you can find a good used car, then it will almost always be a better financial decision (lower monthly and total costs) to get the used car. Although this spreadsheet does not show the effect of buying new vs. used over a 10-30 year period, the total purchase cost and total financing cost over the long term will usually be much higher for a brand new vehicle. If you are thinking of buying new, don't underestimate the maintenance costs. If you can avoid buying a lemon, you may get by for a few years with just the routine maintenance costs, but it won't be long before you need new tires, new brakes, etc. A resource that may be helpful long term is our Vehicle Maintenance Log where you can keep track of your vehicles' maintenance to refer back to when needed.

How long will these cars last?

When comparing new vs. used, or new vs. keeping your current car, it may be important to consider how long it will be until you'll need to make your next vehicle purchase. Maybe your current car will last you another 10 years, or maybe only one more year. A used car may not last as long as a brand new one.