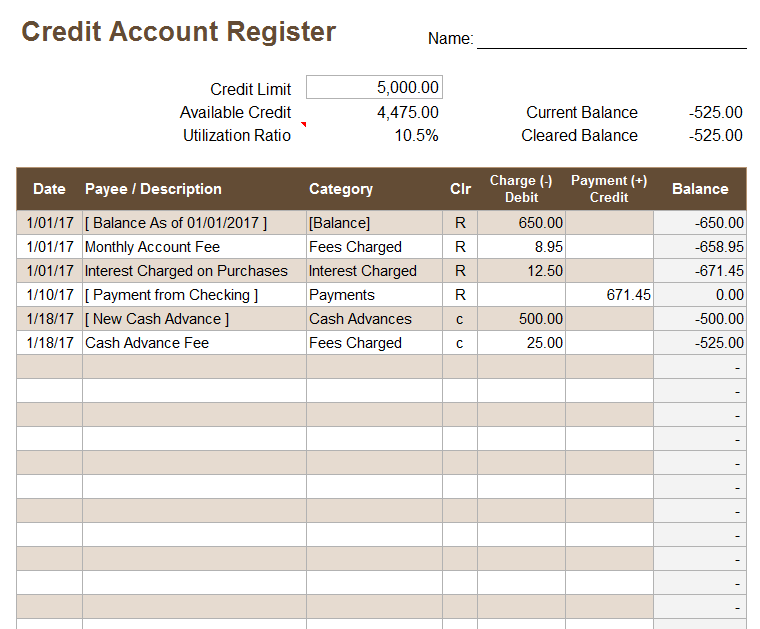

Credit Account Register Template

To use a credit card responsibly, you need to keep a detailed record of your transactions, fees and payments. You can use a credit account register to help you do that. If you are using Quicken or other money management tools, you can set up accounts for your active credit cards and keep track of them just like you would a checking account. That is also what this template was designed for.

Credit Account Register Template

for Excel or Google SheetsDescription

I created this credit account register template based on my Excel Checkbook template, but it includes some summary details specific to credit cards such as the credit limit, available credit and current utilization (debt-to-credit) ratio. If you are concerned about your credit score, you will want to keep your utilization ratio less than about 25%.

The register also includes a Tags column and a Memo column for including other details (not shown in the screenshot above). The Tags column can be useful if you want to sort or filter the table based on criteria other than that in the payee or category column.

Reconciling with Your Credit Card Statement

Your credit card statement will probably show your current balance as a positive number even though it represents an amount that you OWE. Like the account registers in the money management template and checkbook register, in this template a negative balance means you owe money. So keep that in mind as you are comparing to your official statement.

Enter an "R" (for "Reconciled") for those transactions that you have compared and matched to your statement. The Cleared Balance at the top of the worksheet includes only the transactions with a "c" or "R" so you can use that balance to compare to your statement.

The categories that show up in the in the table can be customized in the Settings worksheet. The default list of categories is the common list that may show up on your credit card statement (Fees Charged, Interest Charged, Payments, Cash Advances, Balance Transfers, etc.). Use the Category Summary table to summarize the amounts in these categories for a specific time period (such as the begin and end date that matches your account statement).