Income and Expense Tracking Worksheet

Tracking your income and expenses is one of the first steps in managing your money. I designed this worksheet to use as a printable handout in an introductory personal finance course, but it also functions as an editable spreadsheet. Although I have other finance and budget spreadsheets that do a lot more than this one, if you are looking for a very simple way to keep track of your money, this worksheet can help you get started.

Income and Expense Worksheet

for Excel

Using the Income and Expense Worksheet

I tried to make the spreadsheet as easy to use as possible. If you are using it in Excel on a smart phone, you'll find that it uses a lot of drop-down lists. You can edit those lists in the Settings worksheet.

This worksheet doesn't calculate a summary of income and expenses by category for you (like the Account Register for example). However, if you are comfortable with Excel you could to analyze your income and expenses.

Step 1: Clear the sample data, but don't clear the formulas in the Balance column.

The sample data is there to give an example of how you can enter beginning balances, transfer money between accounts, and enter some basic expense transactions.

It is not necessary to use the worksheet for ALL your accounts in one register. You could duplicate the worksheet and use one worksheet for each of your accounts if you wanted to.

Step 2: Enter beginning balances for the accounts you want to track.

This isn't necessary, but it's what you would do if you wanted to keep track of each account balance. There is actually a hidden column that you can unhide that will show your current Account Balance.

Step 3: Edit the Accounts and Categories lists in the Settings worksheet as needed.

These lists control what is shown in the drop-down lists for each column. It isn't necessary to use the drop-down lists - they are just for convenience.

If personal finance scares you a bit, it may be easier to start with just a few expense categories. When you are ready for something more advanced, you might want to try the Money Management Template.

Step 4: Update the Income and Expense Worksheet daily.

If you are using the worksheet on your phone, you can edit it on the go. If you are using the printed worksheet, you can take it with you in your wallet or purse and edit it whenever you make a purchase.

Another approach is to make notes on a 3x5 card or make notes on your phone about your spending, and then update your worksheet at home.

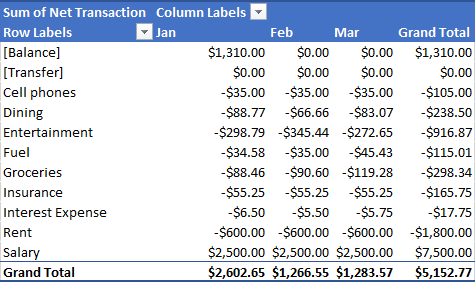

Step 5: Create a Pivot Table to Analyze Income and Expenses

The image below shows an example of the type of report you can create fairly easily using a Pivot Table in Excel. For detailed instructions, see the blog article written by guest author and Microsoft MVP John MacDougall: .

Tip: If you use a Pivot Table in Excel 2013 or later, I'd recommend trying the new Timeline feature. This makes it easy to select the range of dates to display in your table. Click inside the pivot table, then go to the Analyze tab and click on Insert Timeline.