Rental Application Form Template

Whether you are doing 'for rent by owner' or renting one of several investment properties, tenant screening is a very important part of being a landlord. Use our free rental application forms to help you collect vital information about potential tenants. Continue reading after the download block for additional tips for finding good tenants.

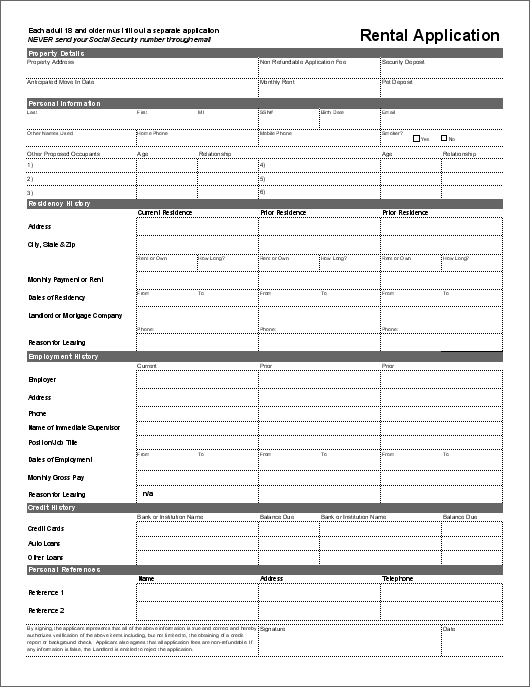

The free Rental Application Form template contains two different forms – a 1-page basic application and a longer detailed version which collects additional information about the applicant.

Use the information gathered on these forms to identify promising tenants, to ask additional questions and to follow-up with prior landlords, employers and references.

Rental Application Form Template

for ExcelUsing the Rental Application Form

Here are some tips to help you find and secure the right tenants:

- Verify – Use the information you receive on the application to do tenant checks. Check rental references and verify employment.

- Credit Scores – Pull credit scores to help screen out potentially bad tenants. Make sure you get their permission - usually through the application. It is not uncommon for the applicant to be required to pay for the credit check. Just make sure you know how much it will cost before accepting their application.

- Cashier check - Require deposits and first month's rent be paid by cashier check. If accepting a personal check, wait to make sure it clears before handing over the keys.

- Meet them – Make sure you meet the applicant in person. Meeting them face to face will provide you with additional insights into how they will treat your rental.

- Contract – Make sure you find a good rental agreement and get it signed before handing over the keys. Not only will a contract help you legally, but it ensures that there is no miscommunication about terms and responsibilities. It also helps everyone remember what was agreed to when it comes time to move out.

More Info about the Credit History Section

One of the best ways to tell if someone is going to pay their rent on time is to check their credit history. There are several ways to do this.

One approach is to obtain a copy of the tenant's credit report. This will give you information about debt and how they repay it. There are a number of services that will allow you to do this. You typically need their first name, middle initial, last name, date of birth and a social security number. Shop around and find the service that provides the information you are looking for. Make sure you get a signed consent agreement to run the credit check. This is usually done through the submitted rental application form (see the note next to the signature).

- There are online services that allow the applicant to initiate the process online, provide the necessary information, pay the credit report fee and have the report sent to you. This allows you to skip collecting confidential information. Important: If you do collect confidential information, make sure you properly secure and protect it.

- Remember that if you ask one applicant for information to run a credit history, you need to ask all of them, to avoid discrimination. Many landlords choose to pre-screen the rental applications based on the other information, and then only run credit checks on the most promising applications.

You can also collect additional information about debt and account balances directly on applications. This can help provide insights in to the applicants' ability to repay. Some landlords will even request copies of bank statements to get a historical insight into spending patterns. Tenants may be reluctant to provide this kind of personal information, so be sensitive.

For more information on this topic, see the resources listed below.

Resources for Landlords

- How Landlords Can Check a Tenant's Credit Report - at www.nolo.com - Very useful information about how to collect and use information about a tenant's credit history, including the legal issues.

- Fair Housing and Equal Opportunity at portal.hud.gov - Government site with publications about Fair Housing rules and policies. Read through them to make sure you are in compliance.

- How to Find Good Tenants at www.allstate.com - List of tips for finding good tenants

- 10 Ways to Find a Good Renter for Your Home at www.military.com - A great list of tips for finding good tenants.

- Ten Tips for Landlords at www.nolo.com - Collection of landlord tips with a focus on legal issues.